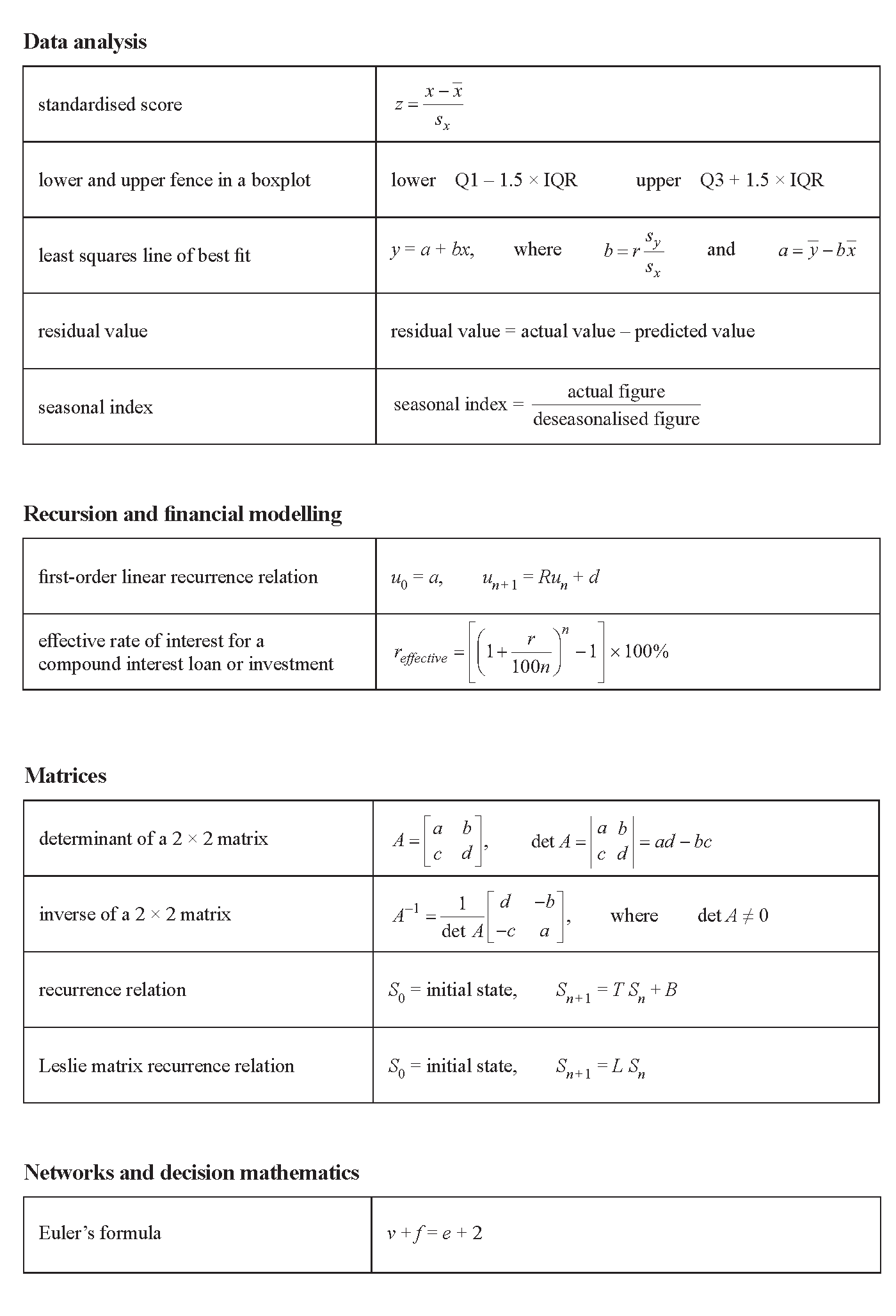

VCE General Maths Recursion and Financial Modelling 2016 Exam 2 Mini Test

VCAA General Maths Exam 2

This is the full VCE General Maths Exam with worked solutions. You can also try Mini-Tests, which are official VCAA exams split into short tests you can do anytime.

Number of marks: 12

Reading time: 3 minutes

Writing time: 18 minutes

Instructions

• Answer all questions in the spaces provided.

• Write your responses in English.

• In all questions where a numerical answer is required, you should only round your answer when instructed to do so.

• Unless otherwise indicated, the diagrams in this book are not drawn to scale.

Recursion and financial modelling - 2016 - Exam 2

Recursion and financial modelling

Question 1 (5 marks)Ken has opened a savings account to save money to buy a new caravan. The amount of money in the savings account after \(n\) years, \(V_n\), can be modelled by the recurrence relation shown below.

\(V_0 = 15000, \quad V_{n+1} = 1.04 \times V_n\)

a. How much money did Ken initially deposit into the savings account? 1 mark

b. Use recursion to write down calculations that show that the amount of money in Ken's savings account after two years, \(V_2\), will be $16224. 1 mark

c. What is the annual percentage compound interest rate for this savings account? 1 mark

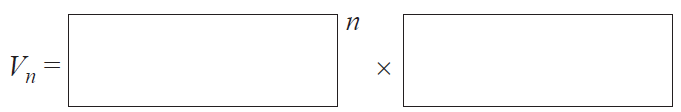

d. The amount of money in the account after \(n\) years, \(V_n\), can also be determined using a rule.

i. Complete the rule below by writing the appropriate numbers in the boxes provided. 1 mark

ii. How much money will be in Ken's savings account after 10 years? 1 mark

Ken's first caravan had a purchase price of $38 000. After eight years, the value of the caravan was $16 000.

a. Show that the average depreciation in the value of the caravan per year was $2750. 1 mark

b. Let \(C_n\) be the value of the caravan \(n\) years after it was purchased. Assume that the value of the caravan has been depreciated using the flat rate method of depreciation. Write down a recurrence relation, in terms of \(C_{n+1}\) and \(C_n\), that models the value of the caravan. 1 mark

c. The caravan has travelled an average of 5000 km in each of the eight years since it was purchased. Assume that the value of the caravan has been depreciated using the unit cost method of depreciation. By how much is the value of the caravan reduced per kilometre travelled? 1 mark

Ken has borrowed $70000 to buy a new caravan. He will be charged interest at the rate of 6.9% per annum, compounding monthly.

a. For the first year (12 months), Ken will make monthly repayments of $800.

i. Find the amount that Ken will owe on his loan after he has made 12 repayments. 1 mark

ii. What is the total interest that Ken will have paid after 12 repayments? 1 mark

b. After three years, Ken will make a lump sum payment of $L in order to reduce the balance of his loan. This lump sum payment will ensure that Ken's loan is fully repaid in a further three years. Ken's repayment amount remains at $800 per month and the interest rate remains at 6.9% per annum, compounding monthly. What is the value of Ken's lump sum payment, $L? Round your answer to the nearest dollar. 2 marks

End of Question and Answer Book

VCE is a registered trademark of the VCAA. The VCAA does not endorse or make any warranties regarding this study resource. Past VCE exams and related content can be accessed directly at www.vcaa.vic.edu.au